Introduction of Sustainable and Responsible Investment (SRI)-Linked Sukuk Framework

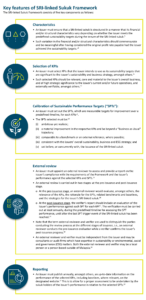

The Securities Commission Malaysia (“SC”) had on 30 June 2022 launched the Sustainable and Responsible Investment linked (“SRI-linked”) Sukuk Framework (“Framework”).[1] Introduced as an extension of the initiatives under the Sustainable and Responsible Investment (“SRI”) Roadmap by SC to broaden SRI products offerings, this Framework is intended to facilitate fundraising by companies in addressing sustainability concerns such as climate change or social agenda.[2] This would enable companies in these as well as other industries to transition into a low-carbon or net zero economy.[3]

With the introduction of this Framework, private financing for sustainable development would no longer be limited to companies eligible to issue sukuk under the SRI Sukuk Framework but would also be available to a wider pool of eligible companies under the SRI-linked Sukuk Framework. Such introduction is timely for eligible companies to tap into the huge global sustainability financing market. As at 31 December 2021, the global sustainable bonds outstanding exceeded USD1 trillion with sustainability-linked bonds making up USD118.8 billion.[4]

What is a SRI-linked sukuk?

Under the Framework, a SRI-linked sukuk is a sukuk where the financial and/or structural characteristics vary depending on whether the issuer achieves its predefined sustainability objectives within a predefined timeline.[5] For example,[6] a company issues a SRI-linked sukuk with a baseline profit rate of 5% per annum. The key performance indicator (KPI) is reduction in carbon dioxide (CO2) emission to 50 million tonne in Year 3 whereupon if it achieves the KPI, the profit rate will be reduced by 25 basis point (b.p.). In Year 3, the external verifier confirms that the CO2 emission target has been achieved. The profit payment is reduced to 4.75% as incentive for achieving the objective.

Differences between SRI-linked sukuk and SRI sukuk

Such primary feature of a SRI-linked sukuk greatly differs from that of a SRI sukuk where there is no such feature i.e. variation to the financial and/or structural characteristics for SRI Sukuk.[7]

Further, there is no restriction on the use of the SRI-linked sukuk proceeds. Proceeds raised from a SRI-linked sukuk may be utilised for general purposes, whereas the proceeds from a SRI sukuk issued under the SRI Sukuk Framework must be applied exclusively for funding of any activities or transactions relating to the eligible SRI projects[8] as set out in Chapter 20 of the Guidelines on Issuance of Corporate Bonds and Sukuk to Retail Investors (“Retail Bonds Guidelines”).

SC has also announced on 23 August 2022 that the SRI Sukuk and Bond Grant Scheme, to facilitate companies raising sukuk to meet sustainable finance needs, will also be extended to the Framework.[23] This will enable eligible SRI-linked sukuk issuers to apply to the Grant Scheme to offset up to 90% of the external review costs incurred, subject to a maximum of RM300,000 per issuance. The expansion aims to encourage the issuances of SRI-linked sukuk by companies in carbon-intensive industries as they transition to better sustainability practices and low-carbon activities.

Further details of the requirements for the SRI-linked sukuk are set out in Chapter 9 of Part 3 of the Guidelines on Unlisted Capital Market Products under the Lodge and Launch Framework and Chapter 23 of the Retail Bonds Guidelines.

A set of Frequently Asked Questions issued by the SC on the SRI-linked Framework can be accessed here.

If you have any questions or require any additional information, please contact Andreanna Ten Maven or the Zaid Ibrahim & Co. (a member of ZICO Law) partner you usually deal with.

This alert is for general information only and is not a substitute for legal advice.

[1] Securities Commission Malaysia, ‘SC releases new sukuk framework to facilitate companies’ transition to net zero’ (30 June 2022) <https://www.sc.com.my/resources/media/media-release/sc-releases-new-sukuk-framework-to-facilitate-companies-transition-to-net-zero>.

[2] Supra note 1.

[3] Supra note 1.

[4] Securities Commission Malaysia, ‘SC releases new sukuk framework to facilitate companies’ transition to net zero’ (30 June 2022) <https://www.sc.com.my/resources/media/media-release/sc-releases-new-sukuk-framework-to-facilitate-companies-transition-to-net-zero>.

[5] Securities Commission Malaysia, ‘Frequently-Asked Questions Sustainable and Responsible Investment Linked (SRI-Linked Sukuk Framework)’ (30 June 2022) <https://www.sc.com.my/api/documentms/download.ashx?id=d34d6f67-8f41-4e20-a478-b54fbb817389>.

[6] Supra note 5.

[7] Supra note 5.

[8] Supra note 5.

[9] Paragraph 23.08, Retail Bonds Guidelines.

[10] Guidance to Paragraph 23.08, Retail Bonds Guidelines.

[11] Paragraph 23.10, Retail Bonds Guidelines.

[12] Guidance to Paragraph 23.10, Retail Bonds Guidelines.

[13] Paragraph 23.12, Retail Bonds Guidelines.

[14] Guidance to Paragraph 23.12, Retail Bonds Guidelines.

[15] Paragraph 23.13, Retail Bonds Guidelines.

[16] Guidance to Paragraph 23.13, Retail Bonds Guidelines.

[17] Paragraph 23.16, Retail Bonds Guidelines.

[18] Paragraph 23.17, Retail Bonds Guidelines.

[19] Supra note 5.

[20] Supra note 5.

[21] Paragraph 23.19, Retail Bonds Guidelines.

[22] Paragraph 23.20, Retail Bonds Guidelines.

[23] Securities Commission Malaysia, ‘Expansion of SRI Sukuk and Bond Grant Scheme to Facilitate Sustainable Finance’ (23 August 2022) <https://www.sc.com.my/resources/media/media-release/expansion-of-sri-sukuk-and-bond-grant-scheme-to-facilitate-sustainable-finance>.