Financial Stability Board issues consultative paper on regulation of global stablecoins

The Financial Stability Board (“FSB”) has released a consultative paper on the regulatory, supervisory and oversight challenges raised by global stablecoin (“GSC”) arrangements. The FSB is an international body that monitors and makes recommendations about the global financial system. FSB members include Singapore, the G20 countries, and various international financial institutions.

The consultative paper sets out 10 high-level recommendations for central banks to “advance consistent and effective regulation and supervision of GSC arrangements”, and key international financial regulatory standards that could be applicable. The FSB’s consultation is open until 15 July 2020.

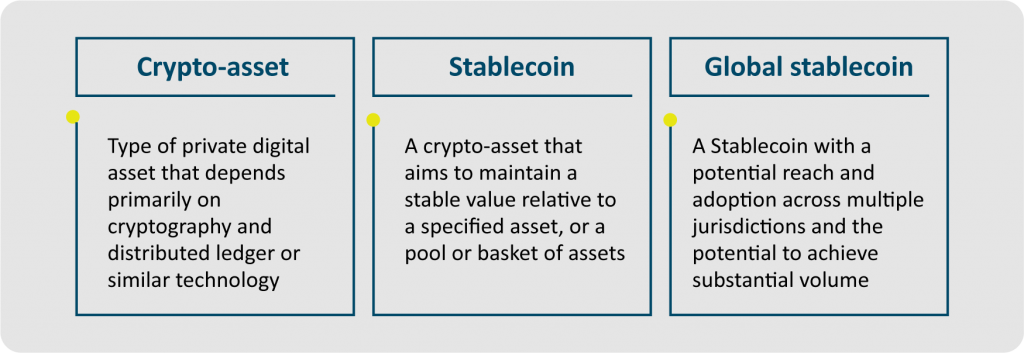

What are Global Stablecoins?

Due to the scale of GSCs, they may pose systemic risks to the financial system and significant risks to the real economy. Some factors that can be used to determine whether a stablecoin qualifies as a GSC include the following:

- Number and type of stablecoin users

- Number and value of transactions

- Size of reserve assets

- Value of stablecoins in circulation

- Number of jurisdictions with stablecoin users

- Market share in each jurisdiction

The FSB also points out that it is important to consider the potential extent of the stablecoin’s use as a means of payment or store of value across multiple jurisdictions. For instance, if a GSC was primarily used as a means of payment but not as a store of value, its potential impact on financial stability may be less significant.

Decentralised Arrangements

The FSB highlights that decentralised processes in GSC arrangements can pose governance difficulties. Fully permissionless ledgers could pose challenges to accountability, governance, and compliance with AML/CFT risks. Such mechanisms “may not be suitable if regulators cannot be assured that appropriate regulatory, supervisory, and oversight requirements are satisfied”.

High-Level Recommendations

The 10 high-level recommendations are aimed at helping authorities determine their regulatory, supervisory and oversight approaches to mitigate risks that GSCs may pose. They are not intended to “represent a complete framework that addresses all the risks and responsibilities of GSC arrangements”.

A selection of the recommendations is set out below:

- Governance. Authorities should ensure that GSC arrangements implement a comprehensive governance framework with clear allocation of accountability for relevant functions and activities.

- Transparency. Authorities should ensure that GSC arrangements provide to users and relevant stakeholders comprehensive and transparent information necessary to understand the functioning of the GSC arrangement, including its stabilisation mechanism.

- Legal Clarity. Authorities should ensure that GSC arrangements provide legal clarity to users on the nature and enforceability of any redemption rights and the process for redemption.

- Regulatory Compliance. Authorities should ensure that GSC arrangements meet all applicable regulatory, supervisory and oversight requirements before commencing any operations. GSCs should also construct systems and products that can adapt to changing regulatory requirements.

The full list of recommendations is available in the FSB’s consultative paper.

Commentary

Issuers of stablecoins and crypto-assets should note that the FSB’s recommendations on GSCs “could also apply to stablecoins or other crypto-assets that pose similar risks”. In addition, it is uncertain whether regulators will allow fully decentralised systems or permissionless arrangements due to governance and compliance challenges. The Monetary Authority of Singapore (“MAS”) has already commenced its review of stablecoins in its December 2019 consultation paper on the scope of e-money and digital payment tokens under the Payment Services Act 2019.

One aim of the FSB’s consultative paper is to lower regulatory arbitrage opportunities by encouraging jurisdictions to adopt a common set of standards. Although jurisdictions may take a different approach in the classification of stablecoins (whether as e-money, collective investment schemes, securities, or derivatives), it is likely that restrictions and reporting requirements across different jurisdictions will converge.

If you would like to discuss the possible impact of the FSB’s recommendations, stablecoins or digital assets, please feel free to reach out to Heng Jun Meng or any director of ZICO Insights Law LLC.

This alert is for general information only and is not a substitute for legal advice.